SEATTLE, Wash. - Over the weekend, the Seattle Times posted an article about rising auto rates. The opening line, or in this case question, is something our team is hearing more and more from clients. Whether you have an older car, maybe you’re not driving as much or as far, you have no accidents or tickets – so, why wouldn’t your insurance premium go down?

It’s a hard pill to swallow when you hear the phrase ‘rising auto rates’ but as far as you’re concerned, nothing has changed in YOUR life to cause the increase.

Since August, in nearly every edition of our monthly newsletter we've covered various aspects of these rising rates across the industry, but we also understand until your policy is up for renewal the information doesn't seem so important. We've heard from clients seeing increases from 3%, to 10%, even as high as 30% at renewal. If you think it's personal - think again.

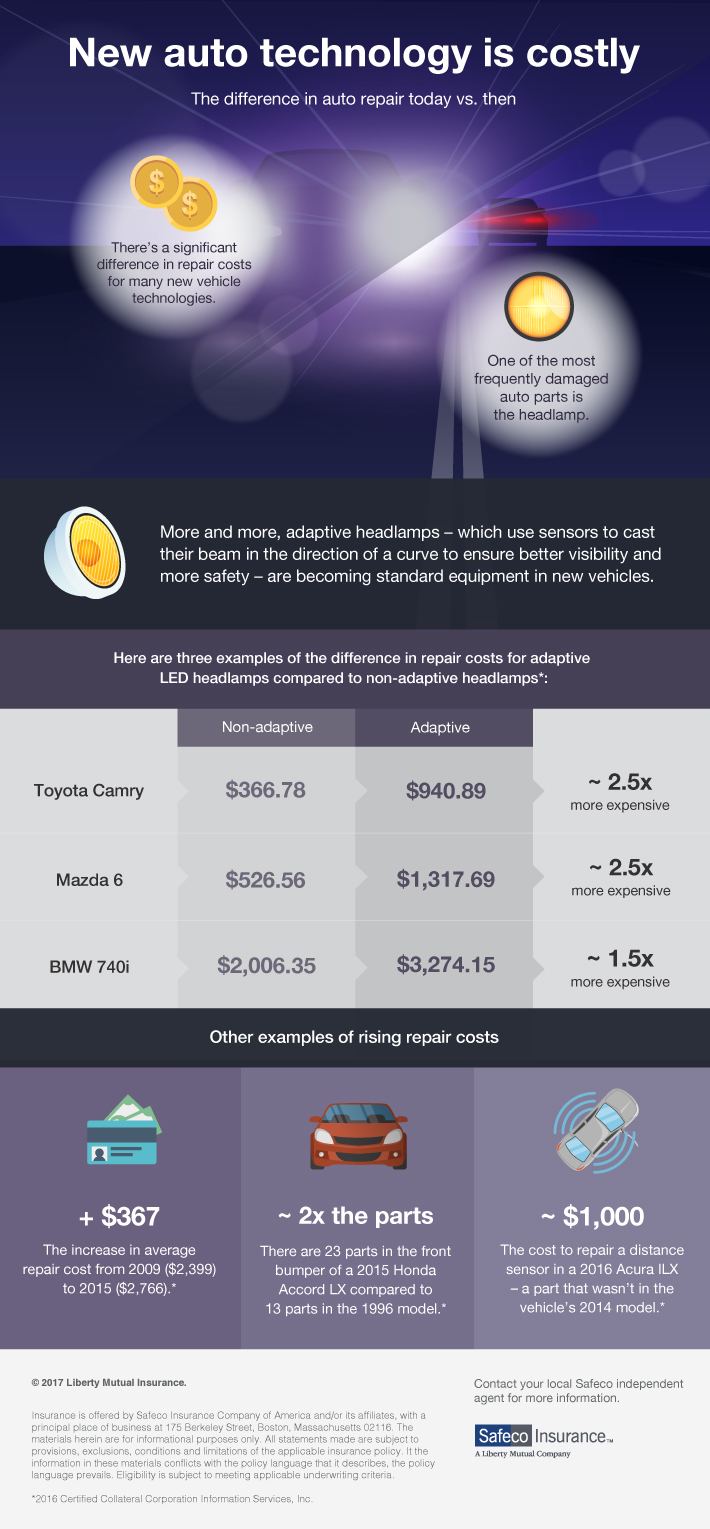

More people on the road, more accidents, higher medical payouts, more expensive repair costs, uninsured/underinsured drivers – each of these factors plays into what’s happening across the board in the auto industry. We aren’t just seeing one or two insurance carriers taking rate – we are seeing rates increasing across the board from well-known direct carriers to small regional and mutual companies.

We included this infograph from our carrier partners at Safeco. This does a good job of explaining how even a headlight on today’s cars can cost more than one thousand dollars to repair.

Come renewal time, if you have questions about your rate please don’t hesitate to contact us. Our priority is to help you understand what’s happening in the marketplace so you can better understand what it means for you and your insurance.